Impact for Generations

Between the Ohio Equity Fund 31 and our proprietary funds with Huntington CDC and Fifth Third CDC, OCCH raised $378M in equity in 2021 in support of our mission to cause the creation or rehabilitation of affordable housing across our footprint. We appreciate the tremendous level of trust our investor and development partners demonstrate in our organization. We are grateful for our many key investment partners who have made investments with OCCH for over three decades, providing housing opportunities for future generations. We thank all our partners for their commitment to the creation of vibrant, sustainable housing that transforms communities and changes people’s lives.

Equity Investment

Affordable Housing Units

Developments

Foreclosures

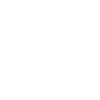

Affordable Housing Investment

OCCH is well capitalized, with a deep bench of market intelligence, financial strength, and innovative resources that investors trust to deliver results. OCCH has built a legacy that thrives on long-term partnerships, while developing new relationships and expanding investment opportunities, to provide the capital to build, change, and revitalize communities.

Investment Partnerships

We believe in the power of relationships and doing things the right way to create deeper collaborations and true partnerships that make a difference in our work and impact together.

We are grateful to the Ohio Equity Fund 31 Investors, including the Impact Investors who commit a percentage of their equity investment to the Ohio Capital Impact Corporation (OCIC). OCIC administers all philanthropic activities that benefit our residents and neighborhoods.

2021 OHIO EQUITY FUND 31 INVESTORS

INVESTORS

Farmers and Merchants State Bank

Farmers National Bank of Canfield

Farmers National Bank of Danville

Fifth Third Community Development Corporation☆

First National Bank of Pandora

Huntington Community Development Corporation☆

Key Community Development Corporation☆

Premier Bank (First Fed & Home Savings)☆

US Bank Community Development Corporation

TOTAL: $312,000,000

*New OCCH Investor

☆ Impact Investors

![]()

Celebrating $1 Billion Investment Milestone

J.P. Morgan has become OCCH’s largest investor, committing more than $1 billion throughout 30 multi-investor funds. OCCH is pleased to commemorate this financial milestone by recognizing the economic and social impact that J.P. Morgan has had in countless communities throughout our footprint.

J.P. Morgan and OCCH have partnered on these investments for more than fifteen years. Our partnership has resulted in 682 developments:

Elderly

Family

Permanent Supportive Housing

Affordable Units

Residents Served

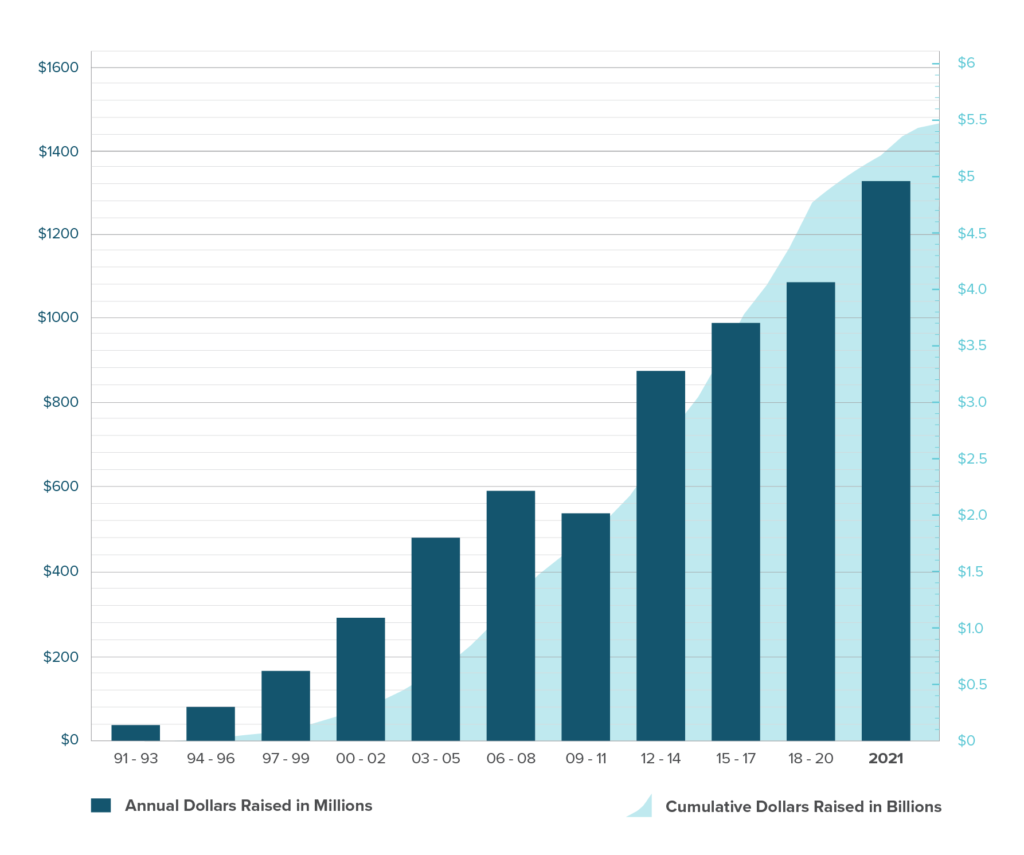

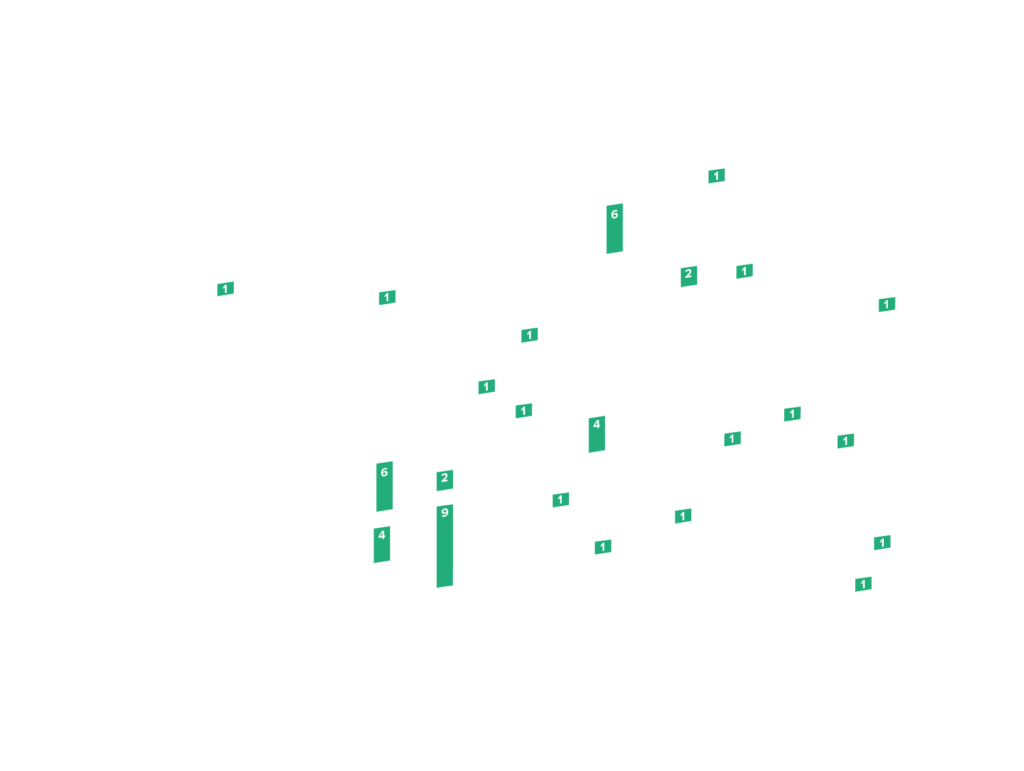

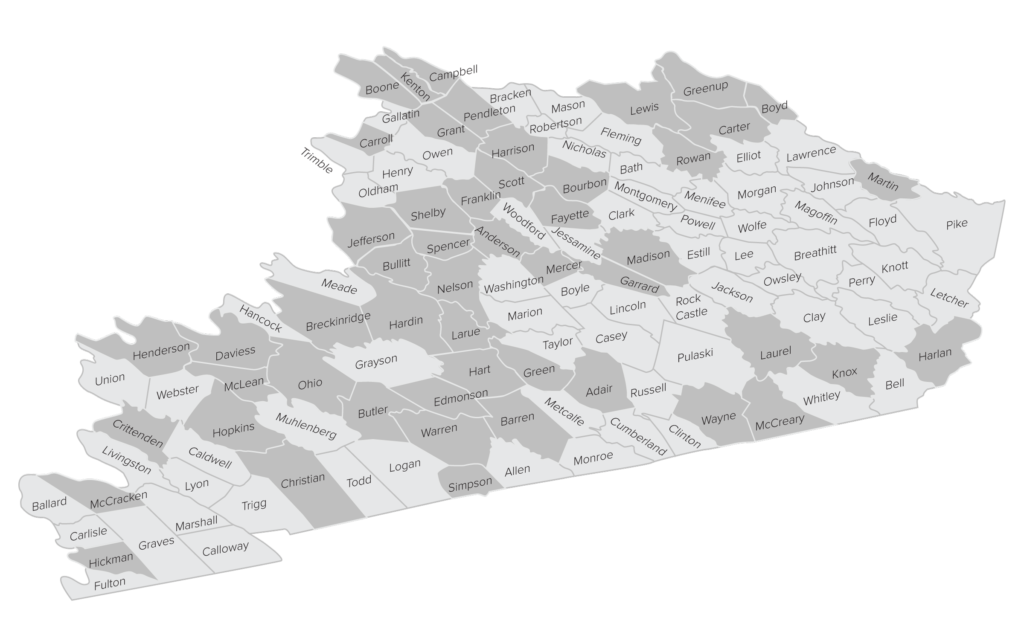

J.P. Morgan’s investment has helped create developments in nearly every county in Ohio, 45 Kentucky counties, 10 West Virginia counties, three counties in Indiana and two counties in both Pennsylvania and Tennessee.

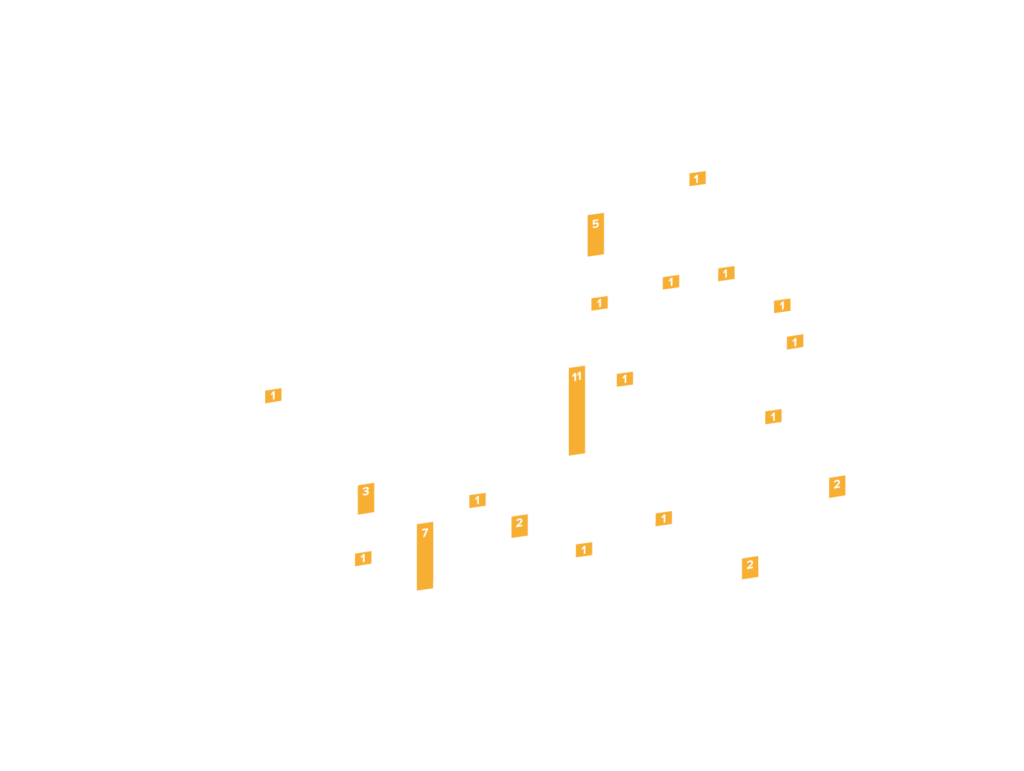

Investing in the Future

OCCH leverages our investor’s capital into affordable housing development, providing stability to vulnerable and underserved populations to build on a future for a better tomorrow. In 2021, OCCH invested $315 million into 40 projects, some of which included Rental Assistance Demonstration for public housing projects, historic preservation developments, permanent supportive housing for veterans and homeless individuals and new housing for working families. The capital we have deployed through our partners has made a real difference to families and individuals throughout our portfolio and continues to revitalize communities and create healthy neighborhoods that empower residents now and into the future.

Projects Closed

Investments Made

Equity Raised in 2021

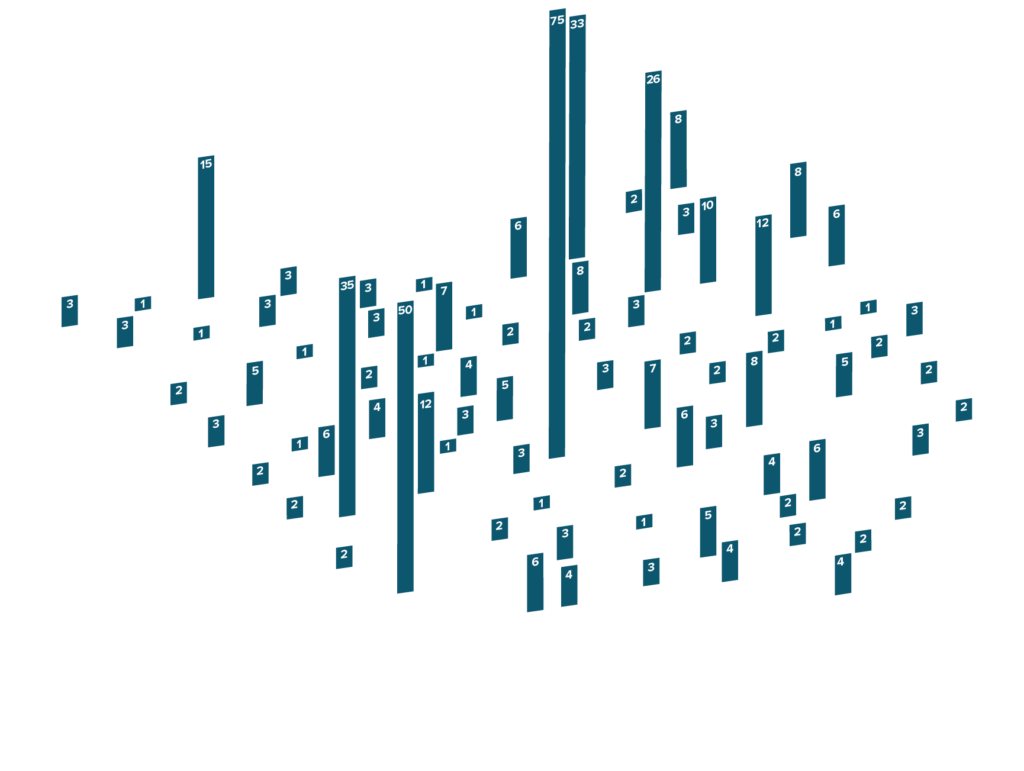

Our Portfolio

OCCH’s commitment to investing in affordable housing and working with our partners to structure and execute strong deals and sustainable projects has resulted in more than 55,000 affordable homes in our portfolio. While the majority of our portfolio is located in our home state of Ohio and counties in Kentucky, OCCH is working with our partners to expand much needed affordable housing throughout Ohio, Kentucky, West Virginia, Tennessee, Pennsylvania and Indiana.

Stabilized

Leasing / Construction

In Development

Stabilized

Leasing / Construction

In Development

Featured Projects

Dayton Arcade

Adaptive Reuse Family Community, Phase Two of the Transformative Dayton Arcade | Dayton, Ohio

The Dayton Arcade is a mixed-use development that involved the adaptive reuse of the historic Dayton Arcade, considered one of the city's most iconic landmarks built in phases between 1902 and 1916. In recent years, however, the Arcade had fallen into decay and had become a blight upon the city. The historic redevelopment not only preserved the historic building, but it provided much-needed affordable housing and commercial options within downtown Dayton.

The Dayton Arcade was redeveloped in two-phases, comprised of commercial redevelopment and residential redevelopment. The first phase consisted of approximately 207,000 square feet of retail, office, and event space. The second phase, and the residential component of the Dayton Arcade, was developed by McCormack Baron Salazar in partnership with the Model Group. The Dayton Arcade features 110 one-, two-, and three-bedroom units with accessible and universal design features, energy efficient features, and a comprehensive list of modern unit amenities. Additional amenities include a multi-purpose room for resident events, a fitness room, and a workforce training room. Of the 110 units, 103 are rent and income restricted to households earning up to 50% and 60% of the Area Median Income (AMI). The remaining 7 units are not rent, or income restricted, and are market rate.

The Dayton Arcade was financed with a mix of low-income housing tax credits (LIHTCs), new markets tax credits (NMTCs), and federal and state historic tax credits (HTCs) to make the rehabilitation possible. Funding for the residential units of the Dayton Arcade included the following:

• $21.3 million 9% LIHTC equity provided by Fifth Third Community Development Corporation investment and syndicated by Ohio Capital Corporation for Housing.

• $6 million Federal HTC equity investment syndicated by Ohio Capital Corporation for Housing with Fifth Third Community Development Corporation as the end investor.

• RBC Tax Credit Equity.

• Nationwide $2.9 million state HTC equity.

• The city of Dayton $2.5 million loan.

• $2.3 million in deferred developer fees and construction profits.

• $1.4 million permanent first mortgage by Ohio Capital Finance Corporation.

General Franklin

Renovated Housing for Veterans | Dayton, Ohio

Miami Valley Housing Opportunities Inc. (MVHO) partnered with the Oberer Companies to completely renovate the General Franklin. Built in 1902 on the Dayton Veteran’s Administration Medical Center Campus, the General Franklin served originally as a dormitory for the US Calvary and later served elderly veterans. It is a contributing structure on the National Register of Historic Places Central Branch, National Home for Disabled Volunteer Soldiers Historic District.

In 2004, MVHO entered an Enhanced Use Lease with the Secretary of Veterans Affairs (the “VA”) for the purpose of operating a permanent supportive housing facility. This lease program is a component of the VA’s mission to end Veteran homelessness. Prior to renovation, the General Franklin provided 34 Single Room Occupancy (SRO) units, common space and once housed the business offices of MVHO.

The renovation replaced critical building systems while also reconfiguring the building to create 38 larger efficiency units and provide much needed improvements for accessibility. All of the units are supported by rental subsidies to ensure residents never pay more than 30% of the rental price. MVHO provides significant on-site supportive services, and works with the Montgomery County coordinated entry system to ensure homeless and those at risk of homelessness have access to the housing and services.

Established in 1991, Miami Valley Housing Opportunities is a nonprofit organization providing safe and affordable housing for those who may otherwise be homeless. MVHO owns or manages more than 500 subsidized, service-supported housing units throughout Montgomery County.

The Oberer Companies, founded in 1949, is a full-service commercial real estate company serving the Greater Dayton area. It has developed approximately 1,000 units of LIHTC housing. Its affiliate, Greater Dayton Construction, served as the project contractor.

Financing for the General Franklin included a construction loan from Huntington Bank, Federal Home Loan Bank Affordable Housing Program funds, Montgomery County HOME, Ohio Housing Trust Fund, deferred developer fees and equity from the Ohio Equity Fund 29 provided by Ohio Capital Corporation for Housing.

Kenlawn Place Homes

Multifamily and Scattered Site Single-Family Homes | North Linden, Columbus, Ohio

In 2021, Homeport celebrated the grand opening of Kenlawn Place Homes. Established in 1987, Homeport is dedicated to providing greater security, opportunity and dignity for low-income individuals and families. Homeport is the largest locally focused nonprofit producer of affordable housing and related services in the central Ohio area.

Kenlawn Place Homes is a 50-unit multifamily housing development consisting of 45 multifamily apartment units and five single family homes. The apartment building features 17 one-bedroom units and 28 two-bedroom units, as well as a community room with kitchenette for resident use. The building also boasts a fitness center, community room and lounge area. The 3-bedroom single family homes are located on scattered sites near the apartment building.

Kenlawn Place Homes is located in the North Linden neighborhood of Columbus, Ohio and represents a strategic step in the revitalization of the Cleveland Avenue corridor. As part of the Homeport community of affordable residential opportunities, residents will have access to a variety of supportive services to ensure stability and growth.

Homeport is especially grateful for the support of New Salem Missionary Baptist Church and the North Linden Area Commission. Both partners played key roles in the design and development of Kenlawn Place.

Financing for Kenlawn Place Homes involved a construction loan from Chase Bank, City of Columbus HOME funds, bridge financing from the Affordable Housing Trust for Columbus & Franklin County, Housing Finance Agency HDAP, NeighborWorks funds, deferred developer fees and equity from the Ohio Equity Fund 30.

Maddox Manor

New Construction of Elderly Units, Passive House Component | Glasgow, Kentucky

Maddox Manor is the new construction of seven, garden-style residential buildings as well as a duplex residential building located in Glasgow, Barren County, Kentucky. Developed by Wabuck Development Company, Inc., Maddox Manor provides 40-units of affordable housing for elderly designated (55+) households with incomes of up to 50%, 60%, and 80% of the Area Median Household Income.

Maddox Manor offers amenities that go above and beyond, including a Passive House component, as well as an on-site Community Service Facility. The property includes a duplex built according to Passive House energy savings design providing a higher level of energy efficiency. The Community Service Facility is operated and managed by Horizon Adult Health Care and offers adult day care, attendant care, and case management services available to qualified tenants. Additional project amenities include on-site parking, on-site management, and a community room. The unit amenities include washer and dryer hook-ups, stove, refrigerator, dishwasher, and central air.

Maddox Manor was developed using a combination of Low-Income Housing Tax Credits awarded by Kentucky Housing Corporation; construction and permanent debt provided by the Cecilian Bank; HOME funds provided by Kentucky Housing Corporation; Bank construction loan concessions; a grant through US Bank; Deferred Developer Fee; and an equity investment in of $6.3 million provided by Ohio Capital Corporation for Housing.

Pinecrest

Preservation of Family Units, RAD Conversion | Cincinnati, Ohio

Pinecrest is the rehabilitation of a nine-story high-rise in the West Price Hill neighborhood in Cincinnati, Ohio, utilizing the Rental Assistance Demonstration (RAD) program through HUD. Developed by Cincinnati Metropolitan Housing Authority, Pinecrest provides 190-units of affordable housing for family households with incomes of up to 30% and 60% of the Area Median Household Income.

Pinecrest offers a variety of project and unit amenities for residents. Project amenities include on-site parking, community kitchen, fitness room, computer room, multi-purpose room, library, laundry facility, security cameras and keyless entry surveillance, and on-site management. Unit amenities include a range, refrigerator, air conditioning, window blinds, energy-efficient appliances, and new kitchen cabinets.

Pinecrest was developed using a combination of Low-Income Housing Tax Credits; bonds issued by the Ohio Housing Finance Agency (“OHFA”) and underwritten by Lument; a HUD 221(d)(4) FHA loan provided by Lument; Cincinnati Metropolitan Housing Authority (“CMHA”) RHF funds; National Housing Trust Funds from OHFA; GP Capital provided by CMHA; Deferred Developer Fee; and an equity investment of $12.7 million provided by Ohio Capital Corporation for Housing.

Santee Landing

Family Workforce Housing | Wadsworth, Ohio

Santee Landing is a new construction 45-unit multifamily housing development in Wadsworth Ohio. Developed by Medina Metropolitan Housing Authority (MMHA) and CHN Housing Partners (CHN), Santee Landing includes a mixture of one-, two-, and three-bedroom units. The project also features a walking trail, outdoor exercise equipment, a playground, and a 90-space parking lot. The park-like setting and great proximity to jobs, amenities, and high-performing schools make Santee Landing an ideal choice for new families.

The genesis of this project is a partnership between MMHA and the Medina County Economic Development Corporation (MCEDC) to address an acute lack of affordable workforce housing in proximity to a growing industrial employer base. The section of Wadsworth where Santee Landing is located has developed into a hub of manufacturing and logistics businesses in recent years. Santee Landing will provide for the workforce housing needs of adjacent employers and house low- and moderate-income families in an area of high opportunity.

Residents of Santee Landing will have the opportunity to grow with the nearby Seville Road employers through training and experience without the challenges inherent to rent-burdened households. This neighborhood was identified as a “Very High” opportunity in the Kirwan Centers Opportunity index in recognition to its excellent proximity to jobs and Wadsworth’s high performing school system. MMHA is actively engaging the Medina Public Transit to expand bus service to this site.

The Summit

Permanent Supportive Housing | Cincinnati, Ohio

Talbert Services partnered with The Model Group to redevelop The Summit to provide Permanent Supportive Housing (PSH) for individuals and families who are homeless or at risk of homelessness.

Originally built in 1668 as a school, Talbert Services has transformed this formerly one-story school into a three-story apartment building, creating a save haven for 58 households. The project will target individuals in recovery from substance abuse and/or individuals with mental illness or other disabling conditions.

The project provides 50 one-bedroom and 8 two-bedroom units targeting PSH-eligible households. The first floor will provide many common amenities including community space, lounges, laundry, and meeting rooms in addition to apartment units. The two upper floors will be primarily residential. There will be off-street parking and an outdoor picnic area. Strategies to End Homelessness (the Hamilton County Continuum of Care) will provide project-based rental assistance and will provide referrals to The Summit through the coordinated entry system.

Talbert House (an affiliate of Talbert Services) was founded in 1965 and has an extensive history of providing behavioral and mental health services, as well as a wide range of housing options, throughout southwest Ohio. It operates multiple service sites throughout Greater Cincinnati and Northern Kentucky.

The Model Group and Model Construction, established in 1978, have developed and constructed over 2,000 units of LIHTC housing. The Summit is the fourth project developed in partnership with Talbert Services.

Financing for The Summit involved a construction loan from RiverHills Bank, Federal Home Loan Bank Affordable Housing Program funds, Ohio Housing Finance Agency HDAP, deferred developer fees and equity from the Ohio Equity Fund 30.

*Photography by Juliana Boehm Photography