Ohio Capital Finance Corporation

Perseverance through COVID: OCFC forged ahead

2021 provided challenges and rewards for the Ohio Capital Finance Corporation (OCFC). The pandemic enabled OCFC to respond to new needs while maintaining its mission of providing responsive and flexible lending products. In 2021, OCFC lent over $80M in capital to create and preserve over 3,100 units of affordable housing located in 35 communities. Notable activities for OCFC included:

– 2 CDFI Awards totaling over $2,400,000

– The creation of the Digital Inclusion Loan; thanks to the creative thinking and funding support from CareSource

– The expansion of the Cincinnati Neighborhood Transformation Fund to $6M of capital for lending

– The implementation of the Linden Healthy Homes Fund, solely capitalized by four nonprofit organizations: Center for Community Investment, CareSource, Robert Wood Johnson Foundation, and OCFC

– The completion of the OH3C Collaborative, culminating in a video highlighting OCFC’s transformative financing dedicated to Columbus’ South Side Neighborhood

Community Development Financial Institution Funding Awards

OCFC was awarded 2 awards from the CDFI Fund to further its mission of lending for affordable housing in Ohio.

Financial Assistance Award – $625,000

OCFC will use this award to expand its lending platform to all phases of the development process: pre-development, acquisition, construction, equity bridge loan, and mini-perm loans. OCFC will achieve this by leveraging an additional $10M in private capital to serve communities suffering from persistent poverty with much needed affordable housing.

Rapid Response Program Award – $1,826,000

The U.S. Treasury’s CDFI Rapid Response Program (CDFI RRP) provided the necessary resources for CDFI’s to respond to the economic challenges created by the COVID-19 pandemic, particularly in underserved communities.OCFC quickly deployed this capital to support the development of 50 units of affordable housing for families in Columbus’ Linden Neighborhood.

Digital inclusion – CareSource and Appalachia

In 2021, OCFC forged a new partnership with CareSource, to meet the digital divide head on. The pandemic created new stresses for those without access to the internet. With $5M of below-market capital provided by CareSource, OCFC created the Digital Inclusion Loan program. This product allowed affordable housing developers located in Ohio’s Appalachia region, to generate additional tax credit equity to fund free Wi-Fi services, purchase equipment, and provide training to their residents. Thanks to the creativity and forward-thinking of CareSource to engage in this 5-year partnership; OCFC, anticipates that over 300 families will now have access to the internet.

Linden Healthy Homes and Community Engagement with 614 for Linden

The 614 for Linden collaborative is comprehensively investing in the North and South Linden to create an equitable, opportunity-rich neighborhood for Linden’s existing residents. To meet the 614 for Linden’s goal to develop and preserve affordable housing, OCFC and Healthy Neighborhoods Healthy Families the affordable housing affiliate of Nationwide Children’s Hospital’s closed on the Linden Healthy Homes Fund, a $4M effort to build and rehabilitate affordable, high-quality rental housing for the people of South Linden. This fund is the first of its kind being funded solely by nonprofit organizations. The fund will focus on building 17 new affordable rental housing units and rehabilitating three others. Construction is underway and all 20 units are projected to be completed in 2022.

Lending during COVID

With funding support from JPMorgan Chase, the OH3C was created and brought together 4 of Ohio’s most active community development financial institutions (CDFIs) to deploy targeted capital in 9 neighborhoods within the state’s 3Cs (Cincinnati, Columbus, and Cleveland). OCFC’s membership in the OH3C was focused on creating affordable housing and spurring community development on Columbus’ South Side.

OCFC supported the South Side’s continued revitalization by helping fund the development of senior affordable housing and creating the $20M Southside Renaissance Fund. OCFC also expanded its reach to a neighboring South Side community, the Near East Side, by supporting a mixed-use development and a local restaurant social enterprise’s expansion to a brick-and-mortar location.

In total, OCFC provided over $20.5 million in loans to support 4 projects: 2 on the South Side with 144 affordable housing units for households with incomes below 80% AMI and 2 commercial projects on the Near East Side. These projects had total development costs of over $44.5 million. One of its projects, What the Waffle, was awarded the “Emerging Social Enterprise of the Year” at Central Ohio’s Aspire 2021 Award Ceremony, a celebration of the local social enterprise community.

Restructure and Expansion of Cincinnati Neighborhood Transformation Fund

OCFC created the Cincinnati Neighborhood Transformation Fund (“CNTF”) to provide capital for projects located within the Cincinnati MSA. Providing flexible capital for the strategic acquisition of real estate is not just a component of the affordable housing development, but an economic development driver for the community by providing goods and services, creating jobs, and promoting entrepreneurship. In 2021, the CNTF funders agreed to increase and extend the CNTF Fund for another three years to assist in further transforming underserved neighborhoods in Cincinnati. OCFC wishes to acknowledge its partnership with the CNTF Funders for making this fund possible: PNC Community Development Co., First Financial Bank, Fifth-Third Bank, RiverHills Bank, and Heritage Bank.

Since its inception in 2018, OCFC’s CNTF has revolved 100% of the capital to assist in the creation of 244,095 square feet of commercial and retail space, 779 residential units, of which 352 were affordable housing units.

OCFC is a Community Development Financial Institution (CDFI) Entity, as certified by the United States Department of the Treasury.

Member of:

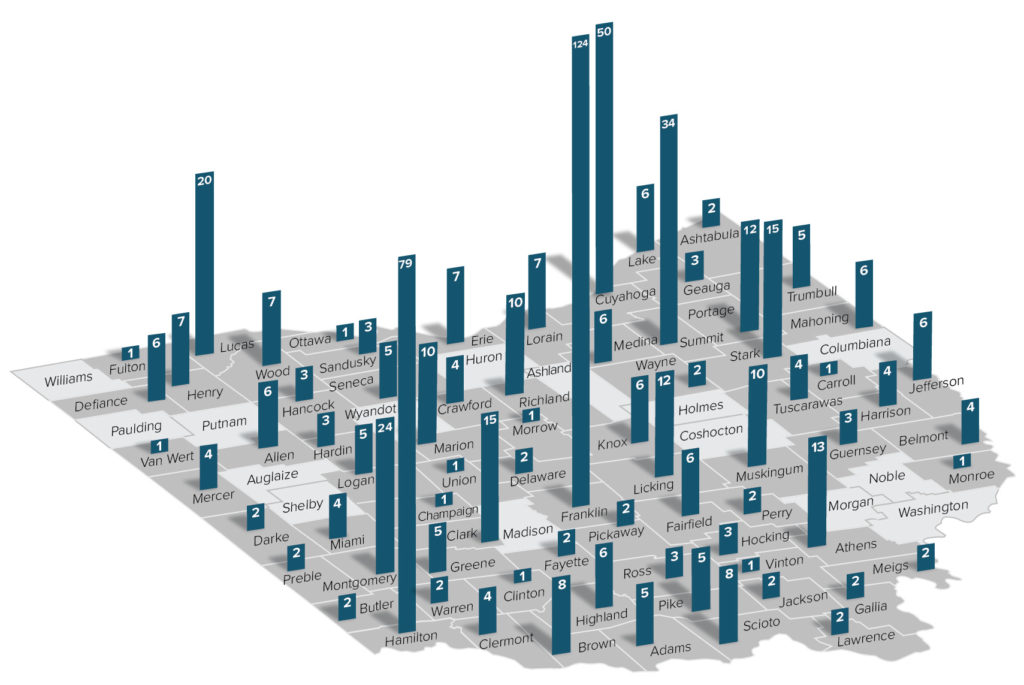

Ohio Loans by County

OCFC has provided loans in 83% of Ohio’s counties.

OCFC’s mission of “providing a flexible source of capital to increase and improve the supply of affordable rental housing across Ohio” has remained steadfast while expanding to meet market needs.

OCFC Partners

OCFC is pleased to recognize the following lenders and investors that allow OCFC to provide the creative financing tools necessary to sustain and produce affordable housing and expand its community development impact.

Accomplishments 2002-2021

Units financed (32% of which were preservation)

Loans closed

Total loan production

Ohio counties (83%) in which loans have been made

2021 Loan Production Distribution

Number of Loans

Hover over the pie chart for more details about each type of loan.

Predevelopment

Acquisition

Y15

Equity Bridge/Construction

CMF EBL

Permanent

Amount of Loans

Hover over the pie chart for more details about each type of loan.

Predevelopment

Acquisition

Y15

Equity Bridge/Construction

CMF EBL

Permanent